Nothing has changed and everything has changed in the markets. Looking back every day since the more than 12 years that this blog has been available, this statement has been true. Even more so in these changing times.

As I have written more than I care to recall, there are only two types of trades: inside out and outside in.

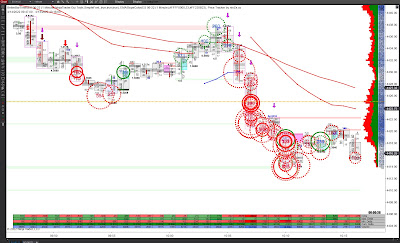

Inside out are trades with the trend that I try and enter on or with pullbacks - breakouts fail most of the time, and outside in trades which are the mean reversion trades.

To take these trades I need to identify the direction of the trend as well as where the mean price is. I then need to look at the order flow to time and trigger my trades. I do all this within a Market/Volume Profile context.

These two charts are able to tell the whole story of what "they" are doing. I often add the Cumulative Volume Delta with its own moving average so I can see if the market is long or short. Its then a matter of processing the information and finding the right location for a trade. There are other things that can be added to charts to give you the information you need buy less is more.

With the extreme volatility we are seeing, trading a bunch of micros for the NQ for the first couple of hours can make scaling out more granular in this volatility.

The "everything has changed" part of the title to this post really refers to the volatility we are getting.Years ago we were complaining of the drop in volatility now people are complaining of the extreme current volatility. Its our job as traders to adjust to these changes. Not making money is not acceptable. Markets are continually changing and its a matter of sticking to a methodology and making changes to fit the changes. With extreme volatility my stops are far away so my risk is much greater. I balance that with smaller size. That means my trade management has to change also or the math won't work. The three metrics are win rate, average loss and average profit. That formula must come up with a positive expectancy.

We have the tools, the knowledge and the requirement of discipline in executing a trading plan. I see opportunity not problems in these markets and am enjoying the daily battles. Glad to be a trader :-) Hope you are too.