My back testing has

become more and more sophisticated as the technology has improved. One of the

things I had decided a long time ago was that my long and short

parameters should be symmetrical. By this I mean, for example, that if

the stop loss is $200 per contract then it should be $200 for long

trades and $200 for short trades.

The reasoning for this was that I wanted to eliminate an element of curve fitting by not having data bias.

But

the market trades differently when it is crashing out compared to when

it is rising because markets just don't fall UP. I have known about this

phenomenon for many many years but have stuck to my guns and have had

symmetrical trading models, both discretionary and auto. The

discretionary ones were less problematic as I used my discretion to deal

with every trade individually and the impact of symmetrical inputs was

somewhat less.

I haven't come to a firm conclusion yet and am still testing but it's worth thinking about.

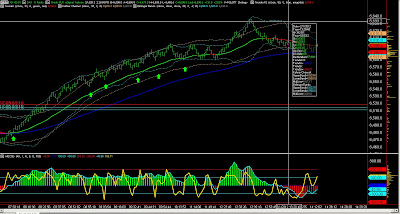

It doesn't get much easier than the DAX in the London morning. The order flow took the market straight up with so much momentum that price never pulled back to the 33 EMA. I then went to slow blow the drive. Now that the snow has stopped, I'm waiting for the sun to come out to I can go and ski.

I haven't come to a firm conclusion yet and am still testing but it's worth thinking about.

It doesn't get much easier than the DAX in the London morning. The order flow took the market straight up with so much momentum that price never pulled back to the 33 EMA. I then went to slow blow the drive. Now that the snow has stopped, I'm waiting for the sun to come out to I can go and ski.

No more renko bars?

ReplyDeleteTom, any thoughts on Cumulative volume up at these levels? Many thanks!

ReplyDeleteAnon 09:38. I now use renkos for most of the time for discretionary trading but not for algo trading.

ReplyDeleteAnon 11:28, Not sure what you are asking. I don't look that long term at CVD. What I can say is that these higher index prices are under lower volumes but overal volume on stcks this January asre said to be down over 20% against last january.