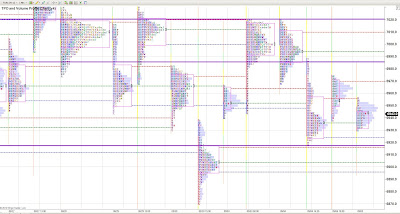

As the volatility in the markets stays low, I find I'm doing more Outside In trades using MarketProfile structure. I've shown some of these trades recently. Today's trade is another one, this time showing the importance of learning to split the Profile to find these support and resistance areas.

Today's high was easy to find. The POC of the distribution to the left of today's Profile coincided with volume, FavFib and a "first touch". I'm still short some after the pic was taken and will cover down to the VAL of the distribution to the left. I expect about 25 points per contract profit.

Tom, Are you splitting the profile into the US session and the overnight?

ReplyDeleteAnon 19:05, I run the DAX as one Profile of 14 hours. For the ES, I look at the 24 hour Profile and the RTH Profile separately. The key, however, is ignoring days and finding distributions and makeing each a Profile.

ReplyDeleteI haven't seen you use the cumulative volume delta of the volume breakdown in a while. Are those gone now?

ReplyDeleteAnon 02:41, CVD is less important these days as it can be hidden a lot. I see the flow in the momentum and what happens at the trigger points.

ReplyDelete