A lifetime ago there was an Abba song we almost sang on the floor: Money, Money, Money, While the Abba girls were looking for a "wealthy man", we, on the floor, were making money, money, money and on our way to being wealthy men if we knew how to exploit the fantastic edge we had on the floor.

The point of saying this is that evolution of the technology we have had since the markets went electronic has resulted in an even playing field for all of us electronic locals. No, we can't compete with the big HFTs but we don't need to. We have our own edge. Our edge is that we can use the latest technology to trade with the agility that trading smaller size allows.

Finally, we can throw away all the indicators we used for entries and exits and rely solely on order flow within the context and market structure we can see using the tools that reveal the playing field we are engaged in. The context I need is to know what sort of day we are in:

- trending strongly or rotational

- where support and resistance is

- where large players may have business to do

- where the Mean is that I continually revert to and break away from

Much of this information I get from my Market Profile/ Volume Profile chart. Ths information helps me to know the "where". My trading chart focuses on order flow and the Mean. This tells me the "when". When + Where = Trade

The chart above is a range chart. No great magic. I often use this periodicity as it gets rid of a lot of noise. I could just as easily use a 1 minute chart or a tick chart. The periodicity of a chart is the microscope that best reveals the order flow. Looking at each tick on a chart is helpful to me. I want to know what the order flow is doing and that is not a single tick but a "flow" of ticks. The ticks can come in fast and furious and the numbers on a footprint chart can change so fast that the eye can't absorb that information. The computer can. Each bar and a series of bars can tell me all that I need to know. The software analyses each bar and series of bars and outputs the information I want using the widgets on the main chart division and with the cumulative volume delta in the division below. The volume profile of the current day on the left side of the chart is the same information I get from the separate Market Profile/ Volume Profile chart I also use.

I am a discretionary trader but use the technology to help me not miss trades as well as to enable me to trigger a trade faster. That's what I call Hybrid trading. When the correct context reveals itself, I arm the algo and when all the order flow conditions I have programmed happen, Flo shoots off the order. She also places stop and target orders that I then move to places related to my money management and to support and resistance places.

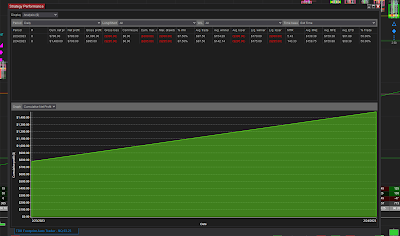

Weekly, on the week-end, I run Flo in playback mode to get an idea of not only how I performed against pure algo but also to help me with stops and targets metrics. The last two days' pure algo results are below.

As I have written many times before, the harder I work the luckier I get. This trading business requires continual monitoring nd re-evaluation to keep on the bleeding edge of performance.

No comments:

Post a Comment