If you have read this blog for a while you will have heard me talking about my meetings with two of THE guys of algo trading: Bob Pardo and Dave Aronson. I met these two guys - separately - in the 1980s and that was the start of my quest to become fully automated.

Having bought an Apple II computer in 1979 and joining the CompuTrac group, I had been using computers and technical analysis for a number of years before finding Pardo and Aronson. An article in a newspaper about artificial intelligence in about 1984 was what started me along this road.

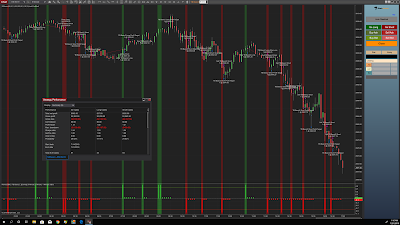

I have finally created an engine to trade purely using order flow. No indicators. Only order flow triggers a trade. The chart below shows Sharkindicators' Raven utilizing logic that I created in their Bloodhound program that reads order flow perfectly and uses my criteria readin g that orderflow to trigger trades.

Exits can be varies according to the style and periodicity I want to trade.

The attached pic shows a very short term trading methodology for the e mini ES that looks to just grab a couple of points at a time and not lose much on a losing trade.

As you can see, this simple method last week made an average of $100 plus per day trading one contract. Just a 2 point target and a 3 point stop. Win rate is over 54%. No filters, just raw order flow.

I have created other Bloodhound logics that have some trend and overbought-oversold filters that do even better as they get rid of quite a few losers and take the win rate up considerably and reduce the draw down. But I wanted to show an example just using the raw order flow as it shows the strength of this methodology.

Guys, Real Order Flow is here!

I plan on being more active with the blog again. I was pretty quiet for a while as I really didn't have anything new to say until now.

Great to see a new post. Still use your idea of order flow in my own trading. Has been and still is an important piece of the puzzle for me.

ReplyDeleteI'd love to see you come back strong...like when you were teaching Kiki way back when. I'm sure she has been CP for years now. It helps to have a built in mentor.

ReplyDeleteWelcome back!

I too know Pardo. He lives near me.

ReplyDeleteJP Morgan doesn't trade the way you are suggesting. They can make particular markets go in any direction they want. Thats the "big" secret. I saw first hand a trader of theirs make a few phone calls and pow! the market went right where he needed it to go.

Thats how you make money without being wrong.

I agree with that fs5. I was trying to say that algos are a very important part of trading now. Yes, retail traders will never be able to trade like the banks. I have known to quants who ran trading groups and they both create and exploit their edges.

Delete