Trader Mentoring: As part of the 90 day follow up mentoring, each participant can have between 2 and 4 hours of personal mentoring with me via Skype or telephone. The time will not all be in one go so you can use it up as you progress during the 90 days and need help with different issues that come up. I want to make sure that everyone "gets it". I'll be available, by appointment, during a 12 hour period every day overlapping most of the time zones. I have decided to offer this as there are some of you who may need it and others of you who will not attend all the sessions will want it. The recorded sessions will show the live markets as they unfold so if you are not in the room but are watching the video after the event, you will benefit in the same way as people in the room. When you add the benefit of the one to one mentoring via Skype, I think you will "get it".

Outside in Trades: As I have said before, outside in trades (the trades that sell and buy tops and bottoms) are higher risk trades. However, when volatility drops, sometimes these are the only trades that make money as the amplitude of the swings are not enough to take the trades from the inside going out.

Typically, these low volatility, trendless times have horizontal EMAs as a feature so they can be recognised. The risk is that the market breaks out of this mode and you get stopped out. There are ways of monitoring the momentum that can alert you to the changes. The interplay between the 2 CCIs reveals a lot. If you go back to periods when the EMAs were horizontal and look at what the 2 CCIs were doing and what they did when the market regained some volatility.

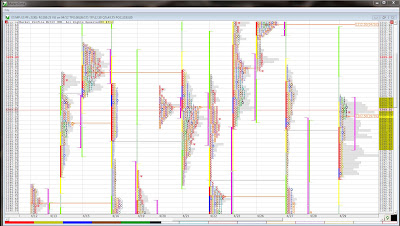

The chart below shows such a period with buy and sell areas marked. Although there was no real range, the 45CCI gave you both direction and protection when the 6CCI pulled back. Quick trades but add up the points made. We will spend time on Outside in trades during the training as they come up, both in sideays markets and also picking tops and bottoms at the end of a trend.

Mind the Gap:

As the underground train (called "the tube" here in London) pulls into a station, there is often an announcement over the loudspeaker ( called a "tannoy" here) warning everyone to "Mind the Gap", the gap between the train and the platform.

Well, today we did have to "mind the gap". Using the context of the Profile with our order flow techniques made for a good payday. In fact I'm still long a piece as I write this and hope to hold it into the close unless we have some major support break.

The world and I sold the open but it wasn't long before I saw the large sells being easily absorbed by the buyers. Whether you were looking at your DOM or inside the bar with Market Delta, you could see the larger sellers hitting the bids but the buyers standing firm.

The secret was the pre-market preparation. There was what I call a "zipper" - a long line of single prints on the Profile and the market was trading right in it when the RTH session opened. The market headed towards closing the Gap between today's open and yesterday's RTH session close. It rode the zipper almost all the way down, but the stubborn buying that was quite visible held and the Gap has not been closed yet today. The first upwave stopped at about 3pm London time when there were some profits taken but the RTH session low held and the buying started in earnest as price rode up to the top of the zipper.

There were a couple of bouts of profit taking which at this time has left a double top.We have been taken into the VA of 23 April and value has been accepted overlapping the tail of 26 April. We are likely to trade up to the 1209.00 VAH or even 1212.50, the POC of 26 April.

As I keep saying, context is everything and I place a different emphasis on different components of "the picture" because of it.

Did you have to start the training on World Cup Finals day :) I guess you're more worried about Rugby! Still considering joining the training though. Thanks for it all.

ReplyDeleteSir, just a point of clarification; the next to last paragraph; IMHO, It does not appear to me that today's value has been accepted overlapping the tail of 26 April. Regards.

ReplyDeleteLoved the part on MP! Why not using delta on the other chart for scalping outside in trades?

ReplyDeleteThanks

Gary, you're right, the date is a typo. We haven't traded up there yet.

ReplyDeleteAnon 18:25, and I'm going to miss some F1 action too.

Jefe, Yes, there were a lot of other trades as the market rotated towards the upper extreme.

Hi Tom,

ReplyDeleteI read the entire blog (twice now) and I noticed you made manuals and some videos for Kiki.

Is there any chance you could make them available for us?

Thank you.

Philip

Another great post again Tom.

ReplyDeleteIn terms of outside in setups, what I experienced, sometimes the market has to show you something. In the case of the long I took yesterday it was the minor HH for me. People get trapped, stopped out after the following dip down and then you got a nice setup.

http://img571.imageshack.us/img571/7191/outsidein.png

I also believe that it is not good to take those setups inside of a range, specially when you had a move with lots of momentum before. Mostly it's just a stall and you get another leg down.

Tom, I have to say that the outside in trades work very nice on the Euro I exclusively trade. Thanks again for your whole sharing and efforts. Of course one has to know in which enviroment (day type) he/she trades and which is the level the market maybe wants to see/test.

In regards to your scalping approach Tom it would be great if you would be great if you could verify what I destilled from your posts.

In an appropriate enviroment (EMAs tight together, potential range day) you buy and sell breaks of the 33 EMA with order flow and a trigger is the fast CCI breaking above/below -100/100? You don't wait for the bar to close and trade the bar close as usual?

As always stop placement (risk) is key, specially for scalping I believe. It would be great if you could comment how you set stops and targets.

Thanks a lot!

Tom,

ReplyDeleteYou said:

"Whether you were looking at your DOM or inside the bar with Market Delta, you could see the larger sellers hitting the bids but the buyers standing firm."

Could you post a picture or explain a little more?

Thank you.