I'm still long ES as I write this post even though there was a lone single print at the bottom of the Profile (at least with my data stream).

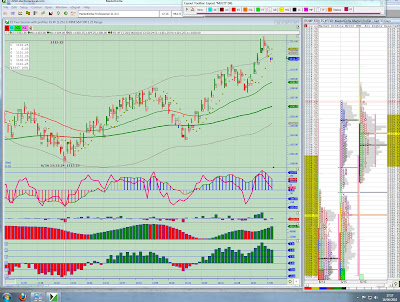

My vision today was a take out yesterday's high and probably a further distribution up. Part of the clue was the several distributions of yesterday separated conveniently by single prints as can be seen in the chart below.

It was much easier that price was below yesterday's close and that the Gap Trade was on. I got myself long around the 1103.50 area and I was out of 2/3rds of my position by the time we got to 1 tick below yesterday's close at 1109.00. What I had scaled out before the single F print at the bottom of the Profile, I bought back at 1103.25 on the way down as I was confident in what I was seeing with order flow. I scaled out a second time on the way up to 1109.00. My next scale points were at 2 handle intervals and I am long a small piece which I will sell at MOC or at break even plus a tick. I had and still have a small risk that the Profile is a neutral day and price will pull back into the middle but I have a free trade now (all of them were break even stop protected by the second rally over 1107.25) so I've stopped work and let the computer manage the rest of the trade.

No comments:

Post a Comment